Business Law & the Affordable Heath Care Act

What Businesses Need to Know about Affordable Health Care Act (most often referred to as ObamaCare)

In Business Law in West Palm Beach companies have been doing their best to understand the implications of The Affordable Health Care Act and their legal requirements. In recent news, The Affordable Health Care Act has been under fire from opponents who argue that the law was written with what they interpret to be a’type-o’.

The current argument:

Section 36B of The Affordable Care Act states that people can be eligible for subsidies (tax credits) if they purchase insurance from “an exchange established by the State”. Opponents of The Affordable Care Act have argued that the phrase “an exchange established by the State”specifically excludes participants in the federally run exchanges therefore making those people ineligible for subsidies from the IRS. The government’s position, which two federal judges have already agreed with, is that the subsidies were intended to be available to those who purchased insurance by either the State or Federal exchanges.

On January 15, 2014, in Halbig v. Selbius, the District Court for The District Of Columbia ruled in favor of the government’s interpretation of The Affordable Care Act that it implies that federal exchanges qualify for subsidies, and on July 22nd 2014, in King v Selbius(Burwell), the US Court of Appeals for The 4th Circuit Court also ruled in favor of the government’s interpretation and found that federal exchanges qualify for subsidies.

However, on July 22, 2014, in Halbig v Burwell, athree judge panel of The U.S. Court of Appeals for the District of Columbia ruled in favor of Halbig and found that the federal exchanges DO NOT qualify for subsidies. The government has determined it will appeal this decision to the entire Court of Appeals for the District of Columbia, because if this ruling were allowed to stand then those who purchased insurance through a federal exchange would not be allowed to receive subsidies, state subsidies will not be available to those who live in states where there are no state exchanges, health care premiums would then be unaffordable, and anyone or business in those states would no longer be subject to penalties for not having or offering insurance.

I like very much how one reporter said, “Don’t go ripping up your insurance card yet” With appeals and more suits to come, this will be an argument that carries on for sometime.

Where is Florida in all of this?

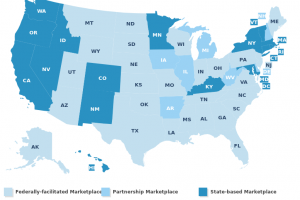

A Picture is worth a thousand words.

The Department of Health and Human Services reported that 983,775 Floridians signed up for health insurance through the Federal Florida marketplace. Of that number, 893,655, or 91 percent, receive a tax credit.

An Urban Institute study funded by the Robert Wood Johnson Foundation estimated that by the year 2016, 1.4 million Floridians will have enrolled in the federally facilitated plan, with 931,000 of those accounts subsidized to the tune of $4.8 billion. Only Texas, with $5.6 billion, has more federal money for health coverage at stake.

How does this affect my business?

In the continued bout, subsidies will continue to flow (as we are told) until there is a United States Supreme Court decision on the matter. Though, businesses and individuals should be aware of what is taking place in courtrooms across the country, work to understand The Affordable Health Act, and know how all of this affects their businesses and their households. We cannot rely on our elected officials to know what the people desire for our state and for our country. We have to tell them. Write to your congressman with your thoughts and write to our governor.

Here’s a reminder of the March 23 2010 Affordable Care Act and how it affects your business.

(taken from Healthcare.gov)

Which businesses must cover their employees

The payment is called the Employer Shared Responsibility Payment and applies to employers of different sizes at different times. Read more below.

- If you have fewer than 50 full-time employees, you’re not subject to the Employer Shared Responsibility sections of the law any year. You may use the SHOP Marketplace to offer coverage for your employees.

- When you buy health coverage for your employees through the Small Business Health Options Program (SHOP) Marketplace, you may qualify for a tax credit worth up to 50% of your premium contributions.

The Employer Shared Responsibility Payment in 2015 or 2016

The Employer Shared Responsibility Payment applies to some businesses with more than 50 or 100 full-time employees who don’t offer insurance, or whose coverage doesn’t meet certain minimum standards.

Regulations announced February 10, 2014 have updated the following:

- which employers must make the payment

- which years some employers must make the payment

- other conditions about the payment

The Internal Revenue Service offers detailed questions and answers about the Employer Shared Responsibility Payment.

The Treasury Department has a fact sheet summarizing recent updates on the Employer Shared Responsibility Payment.

Have questions about the SHOP Marketplace for businesses with 50 or fewer employees? Call 1-800-706-7893 (TTY: 711). Hours: Monday through Friday, 9 a.m. to 7 p.m. EST. Agents and brokers helping small businesses may also use this number.

The Conclusion

Those who succeed in business have a network of professionals who they can draw on when making each decision for their company. Griffiths & Smitherman, P.L. are the Law firm for Business Law in West Palm Beach. We know how difficult it is for business owners in Florida and that is why we make our services available to all businesses. We want Florida businesses to thrive and we would love to partner with you on your legal needs to ensure your business’ success. We will stay on top of changing laws and protect your investment.

Related Posts

- ← West Palm Beach Product Licensing Attorney Advises on Intellectual Property Protection

- Self Employed & The Affordable Care Act →

Recent Comments